closed end credit example

As mentioned above a 48-month personal loan of 5000 featuring a 12 annual percentage rate of interest is a closed-end credit example. Perhaps the most common example of closed-end credit is credit.

/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

Loan Vs Line Of Credit What S The Difference

Its a type of loan with a fixed amount of funds that you generally use.

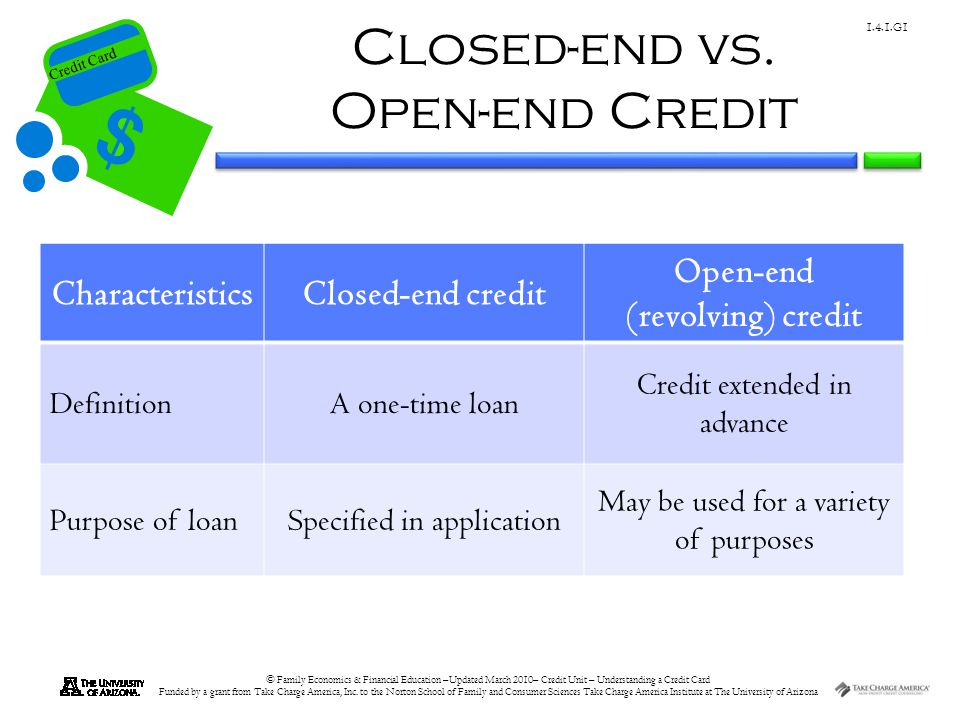

. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date. Open-end credit is not restricted to a specific use. How Closed-End Credit Works.

Credit cards home equity lines of credit HELOCs or personal lines of credit are examples of open-end credit. An agreement or contract lists the repayment terms such as the number of payments the payment amount. September 27 2022.

Mortgage loans and automobile loans are examples of closed-end credit. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. CEC loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date.

495 69 votes Mortgage loans and automobile loans are examples of closed-end credit. You and I agree that I may borrow up to the maximum only one time and subject to all other conditions. Model form H-29 contains the disclosures for the cancellation of an escrow account established in connection.

Mortgage Loan is an Example of a Closed-End Credit. Closed-end credit is a kind of mortgage where in fact the debtor obtains the sum upfront and it is required to repay the borrowed funds after a set schedule. Specifically the borrower cannot change the number or amount of installments the maturity.

Edwardo Hauck I Last update. If you have a mortgage or a car loan you have closed-end credit. An agreement or contract lists.

Closed-end credit such as an installment loan or auto loan gives you a specific amount of money for a set time period. Auto loans typically work the same way but the term of the loan is much shorterfor example a sixty month 20000 auto loan with a 3. Closed-End Credit Examples As mentioned earlier personal loans auto loans mortgages and student loans are examples of closed-end credit.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Closed end credit has a set payment amount every month. An example of closed.

Closed end credit is a loan for a stated amount that must be repaid in full by a certain date. Payday loans are also an. Closed-end credit is a one-time.

Closed End Credit Installment Loans By Mike Fladlien Tpt

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

What Is Closed End Credit Cash 1 Blog News

The 3 Main Types Of Credit Explained Self Credit Builder

:max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-17dca963dbe14826877ea1e67a87451e.jpg)

Debt Statutes Of Limitations For All 50 States

What Are Closed End Funds Fidelity

Closed End Credit Installment Loans By Mike Fladlien Tpt

Fitch Ratings Big Changes For Puerto Rico Bond Market Pdf Bonds Finance Securities Finance

How To Use A Credit Card Best Practices Explained Valuepenguin

Understanding Your Credit Card Ppt Download

Solution Fp101 Phoenix Week 3 Consumer Credit And Scores Quiz Studypool

Credit Basics Vocabulary Flashcards Quizlet

Solved 1 One Example Of Closed End Credit Is A A Credit Chegg Com

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

What Is Closed End Credit Cash 1 Blog News

Solved 1 One Example Of Closed End Credit Is A A Credit Chegg Com

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)